Current ProWein Business Report 2023 out now: “Ways out of the crisis”

02-February-2024Commissioned by ProWein, Geisenheim University polled experts from across the entire value chain of the wine industry in late 2023, for the seventh time now. The over 2,000 industry insiders from all over the world include wine producers from the most important wine-growing countries in Europe and overseas, exporters, importers, specialist wine merchants as well as representatives from the food service/hospitality and hotel industries. The Report follows on from ProWein’s unique, regular “Marktbarometer” (Market Barometer) which has shed light on the international wine industry since 2017. The current Report identifies the key challenges facing the industry during the current economic crisis and flags up solutions which can currently lead out of the crisis in the industry experts’ view.

“Rising costs with falling demand currently present the wine industry with major economic challenges, aggravated still further by the long-term trend towards a healthy lifestyle and altered consumer preferences,” says Prof. Simone Loose, Head of the Institute for Wine and Beverage Business at Geisenheim University, underlining an essential result of the global industry barometer. “Industry experts agree that the wine sector will have to adapt its communication to the needs of young consumers to succeed in reaching out to the next generation of wine drinkers. Also needed to ensure the required profitability will be a structural clean-up of global excess wine production.”

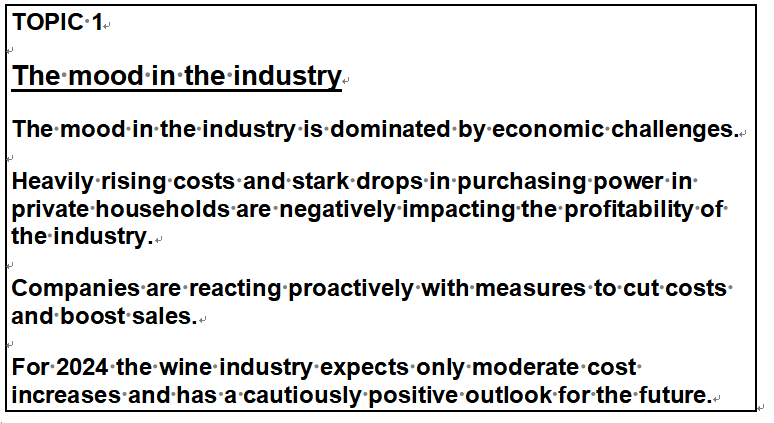

Current challenges for the wine industry

The number of economic challenges has increased against the previous year and now already tops the list with four indicators, although the risk of further cost increases has slightly diminished as a result of declining inflation. The global economic climate, however, continues to be assessed as fragile. Concerns regarding falling wine consumption and the low profitability of the wine industry have increased significantly – the pivotal aspects of this year’s ProWein Business Report.

Chart 1 Threats and challenges for the wine industry

Heat waves in Spain and storms in Italy have further increased the perception of climate change. Owing to the prevailing economic challenges, however, climate change fell back to 5th place in the list.

The supply chains disrupted by the pandemic could largely be restored and no longer constitute a major challenge in the industry’s view. Potential health policy restrictions imposed on the marketing of alcoholic beverages are not perceived as a threat by the industry as yet. For wine merchants staff shortages at 41% rank third in challenges.

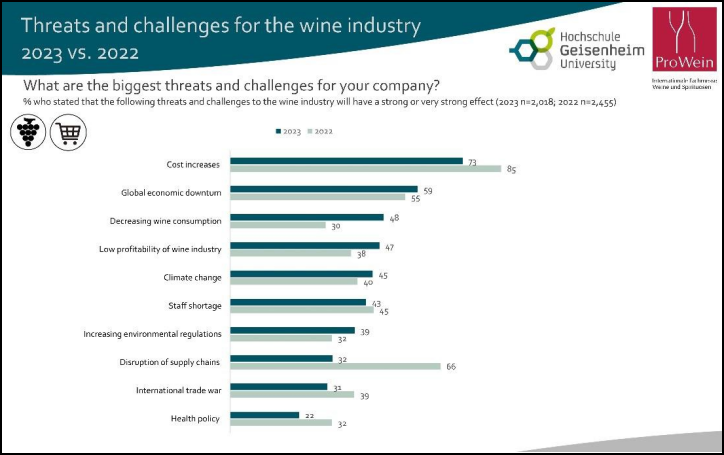

Companies react to economic challenges

Companies in the wine industry have reacted to economic challenges with a multitude of entrepreneurial measures. The overwhelming majority (72% of companies) have tried to compensate for some of the cost increases by hiking prices. This also led to drops in sales due to strong competitive pressure and consumers’ price sensitivity.

Chart 2 Companies’ reaction to the economic crisis

More than one in three companies have undertaken measures to boost sales. These include adapting the product portfolio to the more basic “popular” segment – a market trend that one in two exporters, importers and distributors

have followed. Especially wine-growing estates have revved up their marketing and distribution activities. Wineries and exporters tried to open up new export markets and launched new innovative products, which proved anything but easy in view of globally decreasing wine sales.

Against the backdrop of heavily rising costs two in three companies optimised their costs. Especially wineries and hotels (80% each) as well as estates and restaurateurs (77% each) have undertaken cost-cutting measures. One in two wine merchants lowered their costs by delisting unprofitable wines thereby increasing competitive pressure on their upstream producers, exporters and importers.

Wine producers generally have very high fixed costs due to their vineyards and cellar equipment. Often, they can only cut costs short term by reducing or postponing investment, as done by every second wine estate and every second cooperative in 2023. However, lower investment in production and marketing reduces these firms’ competitiveness in the long term. Due to severe staff shortages, only very few operations (6%) made staff redundant.

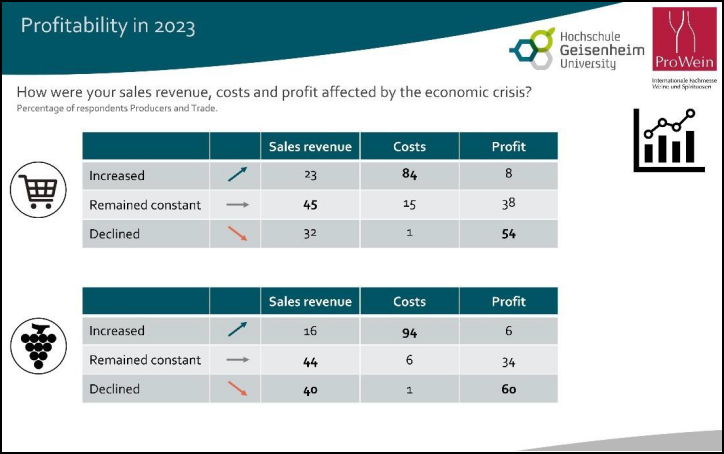

Trend in sales revenue, costs and profit

High cost rises have negatively impacted the balance sheets of nearly all companies producing wine (94%) and trading in wine (Chart 3). Just under half the companies managed to keep sales at the previous year’s levels. 23% of traders succeeded in increasing their sales, while only 16% of producers were able to do so.

One third of merchants (32%) had to put up with a loss of sales due to consumers’ reluctance to buy. At 40% this percentage is even higher among producers. This difference can also be accounted for by merchants’ reluctance to replenish the stocks formed on account of the pandemic during these economically uncertain times. Merchants’ reluctance to re-order is reflected by an even stronger sales decrease for producers.

Chart 3 Economic situation of producers by origin

Rising costs and stagnant or decreasing sales entailed declining revenue for the majority of companies. One third of companies report that profits remained constant, and less than 10% were able to their profits compared to the previous year.

Only moderate further cost increases expected

For 2024 most companies expects costs to rise further. But the majority of these (68% of producers and 70% of merchants) expect this cost increase to be only moderate. To the tune of 15% expect a further strong cost increase. The reason for this also being state measures such as the increase to the minimum wage and the reversion to the higher VAT rate for food service establishments in Germany.

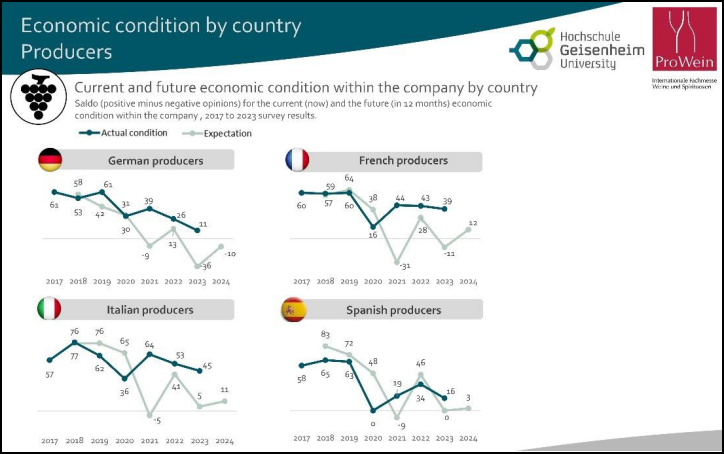

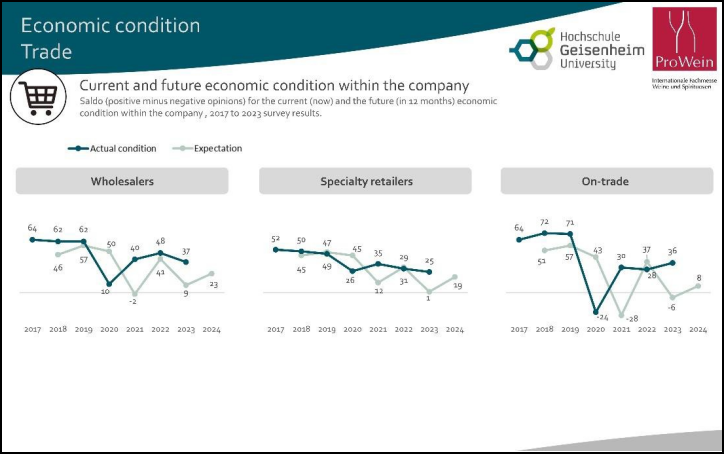

Industry Barometer – slightly positive outlook for 2024

The long-term economic barometer of the ProWein Business Report reflects the difficult economic trend in 2023 and the slightly more positive hope for 2024. In the survey conducted for the last Report in 2022 the companies polled had already expressed rather declining expectations for 2023. This forecast decline has actually materialised accordingly for nearly all stages of the value chain. The only exemption being the hospitality segment which has

benefited from the post-pandemic travel boom and reports an upswing against 2022.

Chart 4 Economic situation of producers by country of origin

Chart 5 Economic situation of wholesale, specialist retail and hospitality

The industry’s economic expectations for 2024 have improved in comparison with the last survey. A trend reversal can be observed in all branches of the wine industry. The absolute level of optimism, however, is still lower than that voiced for 2022, the longed-for first year after the pandemic. In 2024 the wine

sector will still have to operate in a difficult economic environment. But there is hope that the biggest cost increases will have been overcome. Restoring profitability will continue to prove a major challenge for many companies.

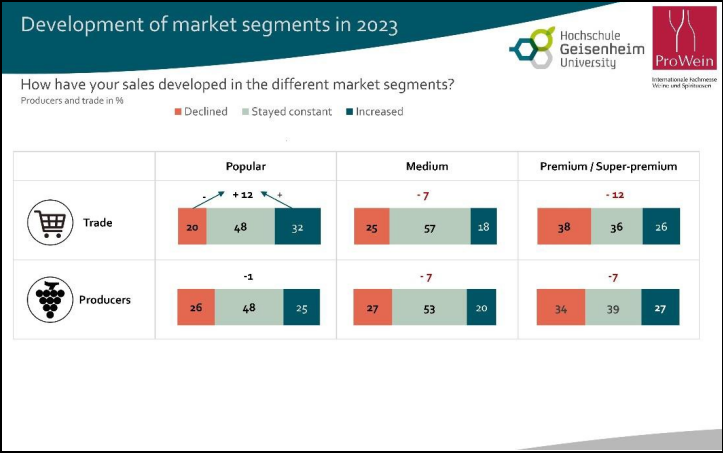

The participants of the ProWein Business Report were asked how the sales shares of the three most relevant market segments – popular (basic), medium and premium and/or super premium – had changed in 2023. Chart 6 illustrates the share of companies with declining, constant and inclining sales in each segment. It becomes clear that the companies performed very differently in the individual segments although certain trends are visible.

In the popular segment 32% of merchants report increased sales and only 20% report decreased sales. This corresponds to a difference of +12%. The popular segment has grown overall in trade. Inflation has reduced the disposable income of many consumers meaning they opted more for lower- priced wines. Producers have not posted such strong growth in the popular segment.

When interpreting these results it should be considered that these are only the companies which could not be weighted in line with their relevance for the market because their sales were not known. Since the companies in the popular segment are bigger as a rule, an even stronger shift of volumes to the lower segment can be expected.

Chart 6 Development of market segments for trade and producers

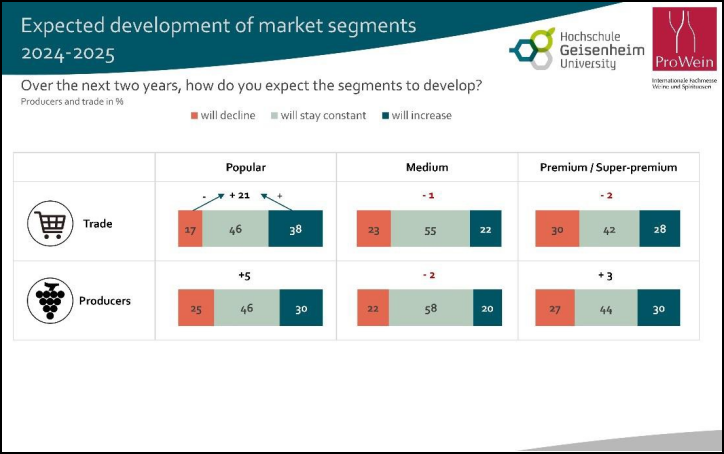

Chart 7 Expected development of market segments for 2024 and 2025

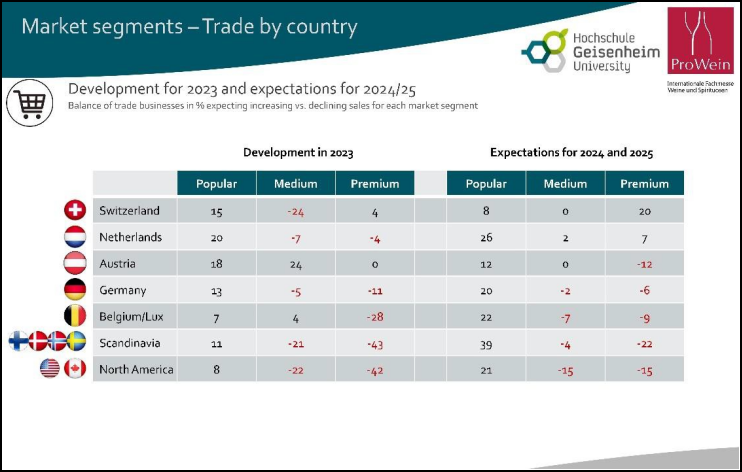

Without prospects of economic recovery, the trade expects the popular segment to grow further in 2024 and 2025, especially strongly in Scandinavia and in the Netherlands. In the medium and premium segments, the percentage of merchants expecting a decline slightly outweighs the companies expecting growth. So slight losses are expected overall.

Chart 8 Trade expectations for market segments to change

Producers expect a polarisation of wine sales with generally low growth in both the popular and premium segments. For the medium segment, however, producers expect a slight decline. The expectations for the future vary widely among producer countries (see Chart 8). The producers from the New World, Portugal and Spain are optimistic, banking on recovery in the medium and premium segments. French producers expect a strong shift to the premium segment with marked losses in the popular and medium segments. Italian producers assume a polarisation.

These results reflect the wide variety of segments and international markets. A great number of different producers will have to adapt to these differing requirements with their respective strengths and position themselves. The strong shift and polarisation of market segments, however, fundamentally impacts the future-proof strategies of wine producers. Sales in the popular segment are enabled above all by strict cost leadership, while sales in the premium segment with limited quantities are only made possible by high quality, regionality, reputation and storytelling. In future, producers will have to specialise professionally in one of these strategies to survive economically.

Producers expect a polarisation of wine sales with generally low growth in both the popular and premium segments. For the medium segment, however, producers expect a slight decline. The expectations for the future vary widely among producer countries (see Chart 8). The producers from the New World, Portugal and Spain are optimistic, banking on recovery in the medium and premium segments. French producers expect a strong shift to the premium segment with marked losses in the popular and medium segments. Italian producers assume a polarisation.

These results reflect the wide variety of segments and international markets. A great number of different producers will have to adapt to these differing requirements with their respective strengths and position themselves. The strong shift and polarisation of market segments, however, fundamentally impacts the future-proof strategies of wine producers. Sales in the popular segment are enabled above all by strict cost leadership, while sales in the premium segment with limited quantities are only made possible by high quality, regionality, reputation and storytelling. In future, producers will have to specialise professionally in one of these strategies to survive economically.

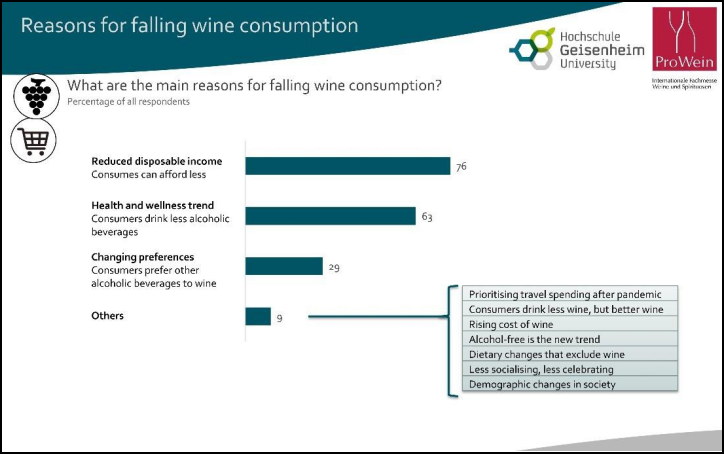

Chart 9 Reasons for falling wine consumption

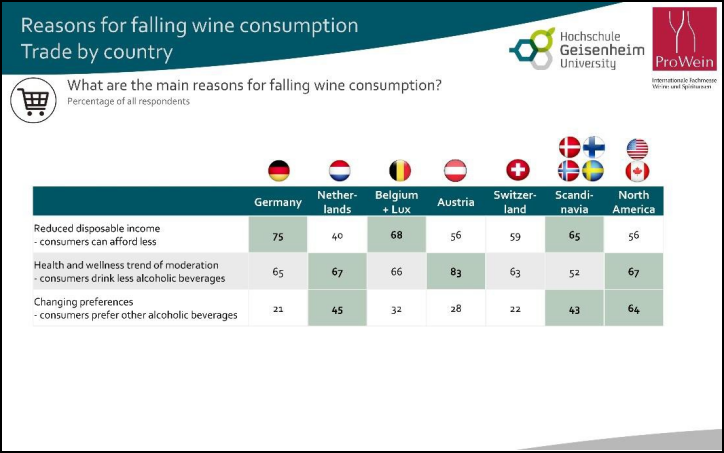

Chart 10 Reasons for falling wine consumption in the trade’s view

The trade currently views reduced disposable income as the most important reason only in Germany and Belgium/Luxembourg. The wide variety of additional comments make it clear that industry experts in many countries perceive a strong trend towards non-alcoholic beverages, demographic change caused by ageing and immigration as well as changed dietary habits.

Given the sometimes great significance attached to the other two reasons, it follows that an economic recovery will not automatically lead to a recovery in wine consumption and the wine sector. The industry will have to adapt to these changes, which are currently still overlaid by economic factors. In view of these changes returning to traditional consumption behaviour does not seem to be possible.

The industry needs to strain every sinew to capitalise on this health trend and bring alternatives such as no-and-low alcohol wines to technical and sensory maturity, so that they are perceived as a genuine alternative to wine by both merchants and consumers. Following the No-and-Low Special ProWein Business Report 2023, there will be a further update on this topic in summer 2024. In competing with other alcoholic beverages for consumers’ favour, the wine industry is also faced with the task of better aligning its communication with their needs.

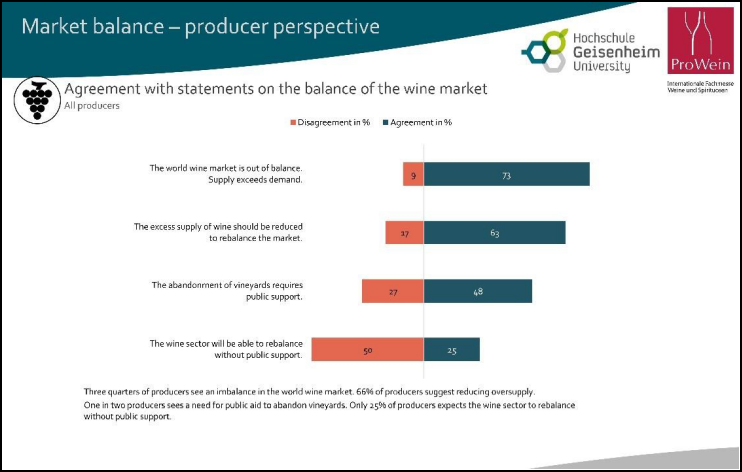

Imbalance of the global wine market

The global decline in wine consumption paired with almost unchanged wine production levels has resulted in an excess wine supply. Three quarters of producers see a clear imbalance on the global wine market. The results are falling international grape and bulk wine prices, whereas costs are rising at the same time.

Wine producers are tied to their investment in the vineyards long term, as these are often written off over a period of 20 or 30 years. This tied-up capital, which cannot be realised when producers exit the market, lead to cut-throat price competition when there is excess supply. This is why the majority of producers call for a reduction of this excess supply so that an economically viable price can form by balancing supply and demand.

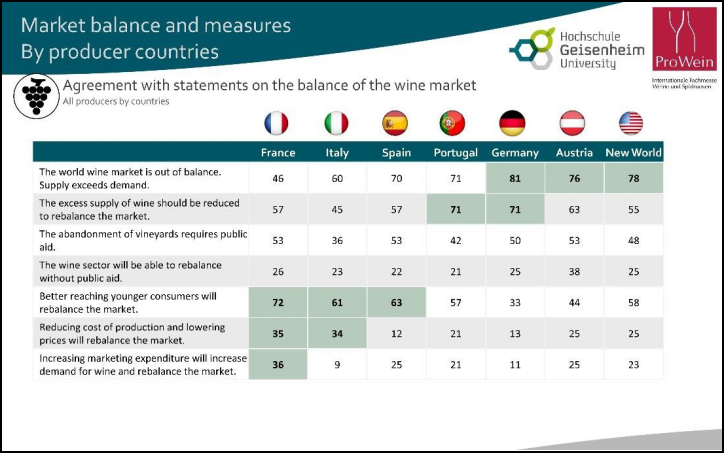

Every second producer considers state support inevitable for setting aside vineyards to end this ruinous competition. Only 23% of wine estates and 11% of cooperatives believe that a new balance will also materialise without state support. It is striking to note that this view is shared internationally by all wine- producing countries, both in the Old and New World (Chart 13).

Chart 11 Producer perspective of the wine market balance

Only some producers rate market-oriented measures as promising. Every second producer sees opportunities for obtaining a new market balance by targeting younger consumers. Especially producers in France, Spain and Italy see the need to make wine more appealing to young consumers. In these three largest producing countries national wine consumption is currently falling fastest due to young consumers’ reservations – increasing the pressure on these countries to export. This is also why they are

particularly interested in preventing domestic wine consumption from going down even further.

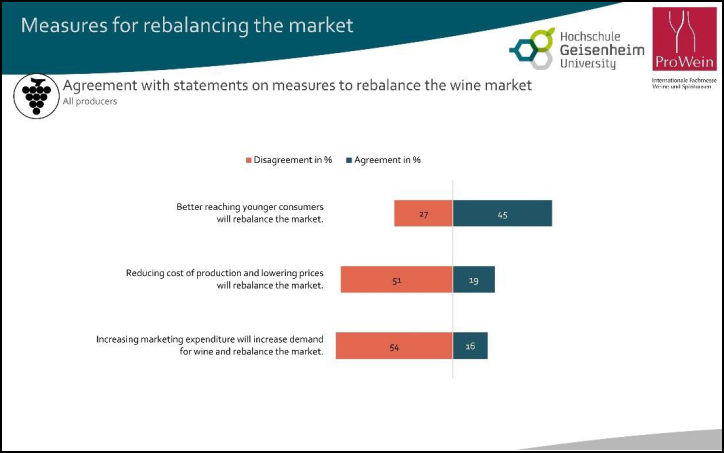

Chart 12 Agreement with measures to rebalance the market

Most producers do not consider offering lower-priced entry-level wines by reducing production costs and increasing advertising expenditure to be effective. There are differences in this assessment both along the value chain and between the individual production countries. The majority of wineries and exporters, who operate more closely with the trade and consumers, see lowering production costs as a positive move. Likewise, producers from France and Italy agree more widely that lower production costs would help entry-price wine offerings. By contrast, almost 90% of Spanish and German producers, who already have very low bulk wine prices by international standards, reject a further lowering of production costs.

Chart 13 Market balance in international producers’ view

Above-average support for higher advertising outlay is only seen among French producers (36%), followed by producers from Spain (25%), Austria (25%) and the New World (23%). Among the various producer types, only some wineries favour higher advertising expenditure (21%). With all other types approval rates are just above 10%. In view of the fierce competition between alcoholic beverages to win consumers’ favour, manufacturers still seem to considerably underestimate the need for advertising.

Other alcoholic beverages reach young consumers better

The industry views targeting young consumers better as a key element in the strategy to reach a new market balance. Since the health and wellness trend emanates above all from the younger generations, who tend to consume fewer alcoholic beverages and later in many countries, it is not an easy task to convince them. There is a multitude of alcoholic beverages vying for young consumers’ attention.

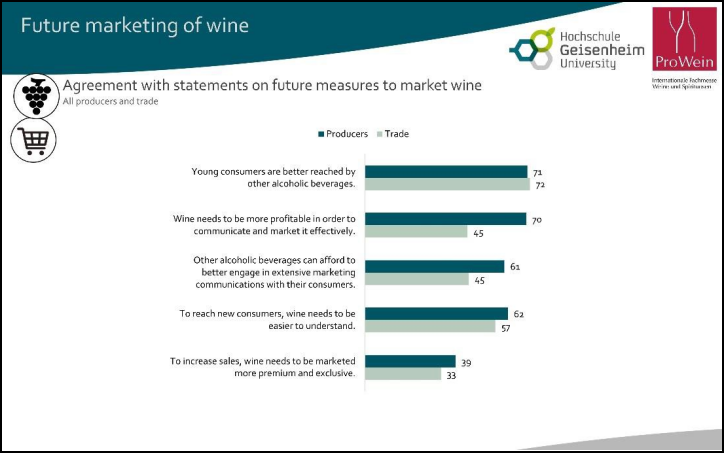

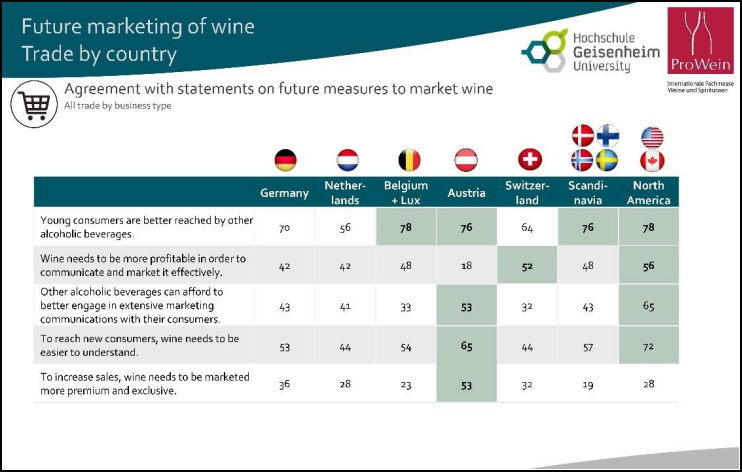

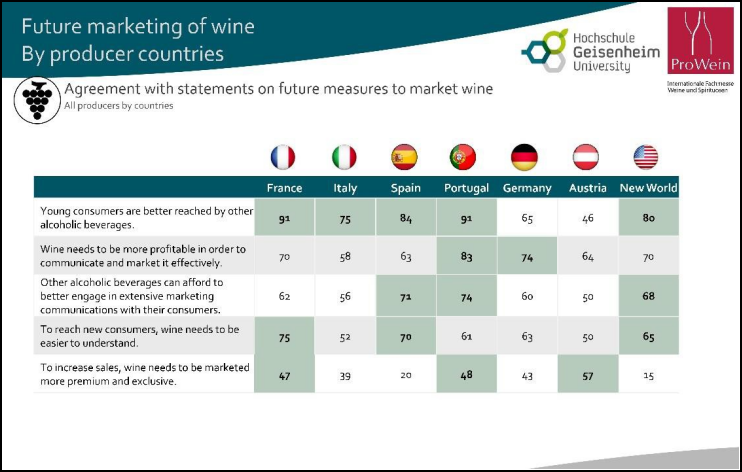

However, the vast majority of the wine industry feels that other alcoholic beverages have an advantage when trying to reach out to new target groups. Over 90% of producers from France and Portugal and over 80% of producers in Spain and the New World agree that younger consumers are easier to reach with other alcoholic beverages (Chart 15). The trade also sees an advantage for other alcoholic beverages in many countries (Chart 16). The high level of agreement between producers from the Old and New World and the trade flags up the international relevance of this challenge.

Wine must be more understandable for new target groups

When asked how wine can appeal to new target groups, the majority of the sector agrees that it must be easier to understand. Here, the approval rates are also highest among the producers from the two traditional wine-growing

countries France (75%) and Spain (70%), followed by the New World (65%). Merchants in the USA and Canada, which are particularly important import markets worldwide, are particularly in favour of the approach of making wine easier to understand (72%). In the European countries the approval rate stands at just over 50%, being highest in Austria (65%) and Scandinavia (57%).

Alternative packaging such as cans, pouches or PET bottles also hold the potential of appealing to younger consumers. The developments in the industry regarding alternative wine packaging will be the theme of a ProWein Special Report in autumn 2024.

The claim of making wine communication easier to understand also impacts wine-growing policies and wine law, which continue to be dominated by geographical demarcations. In an ideal world producers and merchants would agree on concepts that do more justice to target groups in the entry- price segment. ProWein provides an optimal platform for this.

Chart 14 Future marketing of wine in trade and producers’ view

Chart 15 Future marketing of wine in the producers’ view

Only some in the industry see opportunities for an exclusive premium strategy

Wine is a highly differentiated product that has to appeal to consumers with different needs in various market segments. One approach especially suited to the high-end price segment is marketing wine as an exclusive premium product. However, only 33% of trade and 39% of producers overall see high prospects of success for a premium strategy. These values highlight that the premium segment is important but limited.

Chart 16 Future marketing of wine in the trade’s view

Here, views differ widely by country, which can be attributed to the relative market positioning and the developments expected in the premium segment. Especially producers from Austria, Portugal and France regard the premium marketing approach as a bigger opportunity, while only a smaller share of producers in the New World (15%) and Spain (20%) think it is promising. In the trade, especially in the key import markets North America, Scandinavia, Netherlands and Belgium, only a minority of 19% to 28% approve of exclusive premium marketing. Here, too, the approval rates are highest in Austria (53%) followed by Germany (36%) and Switzerland (32%).

Effective marketing requires investment by a profitable industry

Every marketing strategy, be it addressing new target groups or exclusive premium marketing, requires long-term investment. The majority of producers and a large share of the trade feel that other beverages can afford more comprehensive marketing communication. Especially the producers from Spain, Portugal and the New World as well as traders in North America and Austria see the wine industry at a disadvantage when it comes to budgets available for effective marketing.

Other beverages are ahead of the wine sector, especially when it comes to the analysis and strategic use of data and digital communication. March 2024

will see the ProWein Special Report “Digitalisation” published on the current state of play of the digital technologies used in the wine industry so far and the investment planned until 2025.

Effective marketing and digital catchup require sustainable investment by the wine industry, but its profitability is currently not sufficient to do this. Above all producers see the need to improve the profitabilitgy of wine to market it more successfully. In most countries over two thirds of producers demand higher profitability, with values being particularly high in Portugal (83%) and Germany (74%). On the trade side, this demand for higher profitability is shared especially in the USA, Canada and Switzerland. In the other countries the share among merchants is just under 50%.

The industry's future viability depends on a marketing strategy of the future

This closes the circle between the necessary professionalisation and market adjustment of the wine industry and the investment in communication to ensure its continued existence in the future. The industry has to find a new balance with supply and professional structures to meet demand in the long term. Current excess supply, fragmented, in part insufficiently professional structures and ruinous prices prevent the industry from holding its own in the communication competition for tomorrow’s consumers.

To survive in this competitive climate, the wine industry will have to adapt its production structure, ranges and communication to current and future needs. The faster this happens, the better it will be equipped to keep wine on consumers’ beverage menus. In order to achieve this goal, all areas of the industry, especially the trade and producers, must work closely together. As the world’s largest wine trade fair, ProWein is and will remain an important platform for this co-operation and exchange within the industry.

This study was commissioned by ProWein and carried out by the Institute for Wine and Beverage Business at Geisenheim University under the direction of Prof. Dr. Simone Loose. Geisenheim University is known worldwide for its research and teaching in the field of wine science.

ProWein and Geisenheim University look forward to continuing the ProWein Business Report successfully in the coming years. ProWein thus provides the wine industry with a globally unique, regular longer-term “market barometer” answering key sectoral questions in annual special focal topics. We would like to thank the participants of the survey and hope that wine producers and marketers continue their active participation.

Note for editors:

You will find high-resolution visuals for ProWein in our photo database in the “Press Service” section at www.prowein.com

Press contacts for ProWein at Messe Düsseldorf:

Christiane Schorn

Tel.: +49 (0)211/4560 –991

SchornC@mess-duesseldorf.de

Monika Kissing

Tel.: +49 (0)211/4560 –543

KissingM@messe-duesseldorf.de

Caroline Herbertz

Tel.: +49 (0)211 4560-7141

HerbertzC@messe-duesseldorf.de

Luisa Harnau

Tel.: +49 (0)211/4560 – 539

HarnauL@messe-duesseldorf.de

For further information go to:

www.prowein.com or the social media networks Facebook: www.facebook.com/ProWein.tradefair Instagram: @prowein_tradefair

LinkedIn: ProWein